Property Assessed Clean Energy (PACE) Program

**Important PACE Consumer Protection Information**

Energy and wind resistance improvements in Miramar can now be financed through the newly-approved Property Assessed Clean Energy (PACE) program; Miramar property owners can choose PACE as a financing alternative in the form of a loan tied to the property. Financing can be used for qualifying improvements in the following areas:

There are four PACE program administrators approved to do business in Miramar. Property owners are able to choose the provider that best fits their needs:

Frequently Asked Questions about PACE

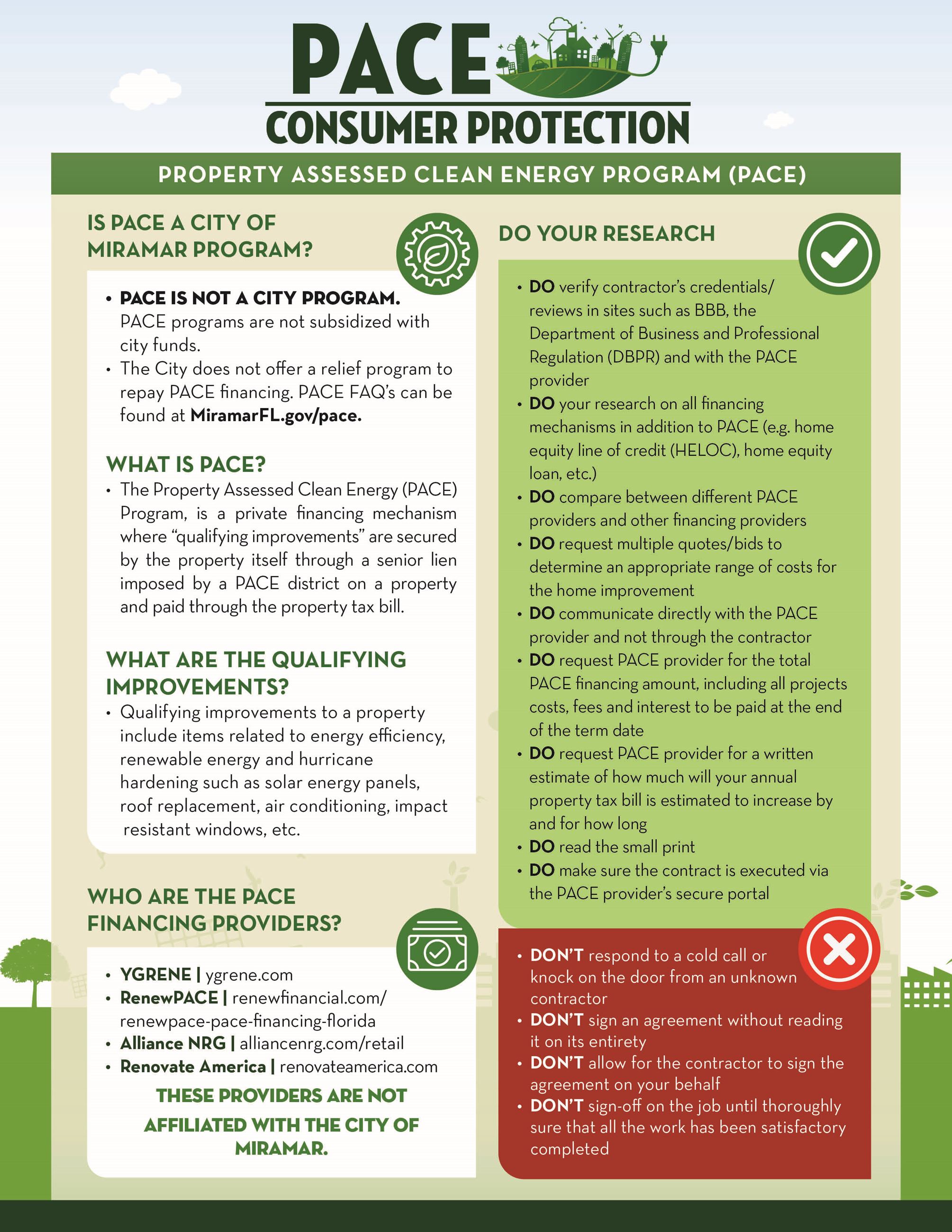

What is PACE?

The Property Assessed Clean Energy (PACE) Program, is a financing mechanism based on a “land-secured financing district” – or Special Districts – where voluntary “qualifying improvements” are secured by the property itself through a senior lien (non-ad valorem assessment) imposed by the District on a property and paid through the property tax bill. Nonpayment results in the same set of repercussions as the failure to pay any other portion of a property tax bill.

What are the qualifying improvements?

Qualifying improvements, per Florida Statute (FS) 163.08, are improvements to the property related to energy efficiency, renewable energy and hurricane hardening. Examples of these are solar energy panels, roof replacement, air conditioning, impact resistant windows, etc. For information click here.

What is the City of Miramar’s role in PACE financing?

FS Section 163.08 allows local governments to enter into Interlocal Agreements (ILA) with Special Assessment Districts in order to enable PACE funding mechanisms within their territory for the cost of qualifying improvements on private property.

In 2016, the City Commission approved ILAs with three Special Assessment Districts for the purpose of providing a PACE program within the City. In 2017, the City Commission approved an ILA with an additional District. The four districts and their administrators are:

YGRENE is the program administrator for the Green Corridor Property Assessment Clean Energy District

RenewPACE (formerly Florida Green Energy Works) is the program administrator for the Florida Green Finance Authority District

EVEST (now Alliance NRG) is the program administrator for the Florida PACE Funding Agency District

Renovate America is the program administrator for Florida Resiliency Energy District

Is PACE right for me?

It is important to understand that PACE is one tool in the home improvement financing toolbox. Other options available include, but are not limited to, cash, home equity loans or lines of credit, energy efficient mortgages, personal/unsecured loans or lines of credit, construction loans, and contractor financing. Each project and individual situation should be carefully examined to determine the best method of financing for you and your project.

Will a PACE assessment affect my monthly mortgage payment?

Since PACE assessments are repaid through your property taxes, if your lender (mortgage company) escrows your property taxes, the monthly payment that you make to your lender will increase to cover the resulting increase in property taxes.

What happens if I sell or refinance my property?

The PACE assessment is the priority lien, and the lien position may impact options to sell or refinance. Some mortgage lenders (particularly Freddie Mac and Fannie Mae) may be unwilling or unable to modify or refinance a property subject to a PACE assessment due to the type and position of the assessment requiring payment in full prior to refinancing or sale of property.

The PACE assessment, and its repayment, may be able to stay with the property. However, the seller, buyer, or lender (mortgage holder) may require the PACE assessment to be paid-off as a condition of the sale or refinancing of the property. Property owners should consult with their lenders at the time of refinance or sale of the property to determine whether they will need to pay off the PACE assessment.

Additionally, state statute requires that, prior to a purchaser executing a contract for the purchase of a property with a PACE assessment, the seller give the following written disclosure statement to the prospective purchaser:

QUALIFYING IMPROVEMENTS FOR ENERGY EFFICIENCY, RENEWABLE ENERGY, OR WIND RESISTANCE. – The property being purchased is located within the jurisdiction of a local government that has placed an assessment on the property pursuant to s. 163.08, Florida Statutes. The assessment is for a qualifying improvement to the property relating to energy efficiency, renewable energy, or wind resistance, and is not based on the value of property. You are encouraged to contact the county property appraiser’s office to learn more about this and other assessments that may be provided by law.

Can I payoff my PACE assessment early? Are there penalties?

Most PACE providers allow early payment of PACE assessments; however, it must be in full. Depending on the PACE provider, there may be a fee and/or minimum payment amount with early payoff. Please contact the PACE provider to determine what, if any, fee or payment they may charge and to discuss early payoff of your project. Additionally, if the payoff occurs after that year’s PACE assessment has been submitted to the property appraiser, the amount of that year’s PACE assessment will not have been included in the pay-off and will still be due with the property taxes.

Example: A property owner, who holds a mortgage, pays off the entire financed amount on year 3 of a 20-year term: the payment is done in December. Since the county tax collector sends a tax bill to each property owner in late October or November, the mortgage holder may require escrow payments during the next year until the tax collector sends next year’s tax bill showing the removal of the PACE lien of the tax bill. Therefore, even when the financed amount has been paid in full, because the tax bill is only calculated once a year, the mortgage lender may require payments until the lien is removed from the tax bill.

What are the interest rates?

Interest rates and fees between PACE providers vary, therefore it is imperative for property owners to do their due diligence by comparing interest rates and fees amongst PACE providers as well as banks and other financing mechanisms; just as importantly, property owners should inquire about the total amortized amount to be paid during the length of the financing period.

What is a fair cost for the qualifying improvements?

Property owners are encouraged to get multiple bids to determine the appropriate range costs of the improvements.

Are the PACE programs funded/subsidized with City funds?

No. PACE is not part of a City of Miramar assistance or relief program and the City does not provide assistance to the property owner.

What happens if a PACE assessment is not paid?

Failure to pay the full tax bill including the PACE assessment could trigger foreclosure and property loss even if the property owner is current on other mortgage lien(s).

Per state statute, a PACE assessment is treated like a lien of equal dignity to county taxes and assessments and is recorded on the property to secure the financing. Therefore, failure to pay a PACE assessment would be equivalent to not paying your property taxes and would follow the same process. Click here for information on Broward County’s process for delinquent property taxes. It is important to note that property taxes are collected annually. It is the responsibility of each taxpayer to know when taxes are due and to pay them before they become delinquent, regardless of whether or not they received a tax bill.

Can I use any contractor?

All PACE providers require contractors to register with their program in order to participate. If you have a contractor that you would like to use that is not registered with the PACE provider that you have chosen, they can register with the PACE provider as long as they meet the PACE program requirements. In general, contractors must possess all valid licenses, certifications, and registrations legally required to do the work requested. Additionally, contractors must maintain appropriate insurance coverage and be in compliance with all other legal requirements to perform the work requested.

Does a condominium qualify for PACE?

In general, condominiums are eligible. Due to the complexities associated with condominium ownership, assessment payments, rules of the condominium associations, and physical unit design, it is best to contact the PACE Providers directly to research eligibility and process. For properties subject to HOA restrictions, it is the responsibility of the Property Owner to obtain authorization that the requested Eligible Products meet all the HOA requirements, as applicable. For specific project eligibility, contact the individual PACE Providers.